Once you have submitted your loan application, the financial institution tend to comment it and decide whether to accept the loan. If for example the financial approves the loan, you might be provided a loan contract you to definitely lines the new terms and conditions of your financing.

The first step to preparing a business loan application is to gather all of the necessary documents. By gathering these documents and filling out a loan application, you will increase your chances of getting approved for a small business loan.

Given that good serial trader who has got increased hundreds of millions regarding bucks having startups, I understand your providers plans taken from incubators are most likely becoming vetted and a lot more very carefully verified. The fresh incubator’s type in to your business strategy can make you research much more polished and knowledgeable – even though you have not focus on a business prior to.

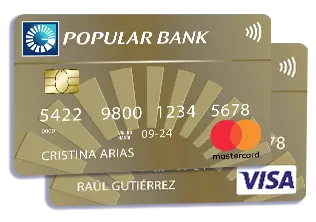

step 1. Credit rating: Loan providers would want to discover a history of for the-time costs, that’s an excellent indicator of just how almost certainly you are to help you pay off that loan.might including check your credit history, which is a variety one signifies the creditworthiness. The higher your credit score, the more likely you are discover accepted for a financial loan and the finest terminology you’re going to be offered.

dos. Yearly revenue: Lenders will want to observe much revenue your online business produces for the an annual basis. This will help to them decide how far currency you could potentially realistically manage to pay back every month.

Loan providers generally speaking wanted equity for funds more than $fifty,000

3. Time in business: New extended your business might have been installed and operating, the much more likely youre to find recognized for a financial loan. This is because lenders glance at people having a longer history as being much safer.

cuatro. Collateral: Many loan providers will demand collateral, that is some thing useful that can be used so you can safer the mortgage if you defaultmon particular security become actual estate, automobile, and you may devices.

5. Personal guarantee: A personal guarantee is a promise from the business owner that they will personally repay the loan if the business is unable to do so. This adds an a lot more coating out of protection for the lender and makes them more likely to approve your loan.

six. Your organization plan is outline your earnings sources, expenditures, and you may growth plans. It should likewise incorporate reveal breakdown from exactly what you’ll use the mortgage to own and exactly how you intend into the repaying they.

After you have a powerful business strategy, it is the right time to begin doing your research for loan providers. There are certain on the internet loan providers one to are experts in small loans. These lenders normally loans The Pinery CO have a streamlined application processes and certainly will score you approved quickly. However, it is essential to contrast cost and you can terms and conditions before choosing a great financial.

5. Collateral: Equity is actually a secured item you pledge while the security for an excellent loan. For many who standard with the financing, the lender can grab the equity to settle the brand new debtmon types regarding security is a residential property, auto, products, list, and you may membership receivable.

I think you to definitely Bitcoin is just about to replace the method in which everything work. Needs entrepreneurs to share with me personally exactly how its going to alter. Create roughly the same as an iron-man fit that have Bitcoin.

6. A fees bundle: Loan providers might like to see an installment plan that contours how you would pay-off the mortgage. This will were details about once you makes repayments, exactly how much might pay each month, and how you will generate costs should your company skills economic problems.

Business strategy: A properly-composed business plan may go a long way inside convincing a lender so you’re able to agree your loan

Once you’ve achieved the necessary files, make an effort to fill out a loan application. The loan app tend to ask for information regarding your online business, your own finances, and your credit score.