On the web Loan Payment Cardio. Check out the Wonderful step 1 Borrowing from the bank Connection On the web Loan Fee Cardio, available through their site. Get on your web Bank-account to help you start brand new percentage processes.

Go to a part. You could make personal bank loan payments when you go to a local Wonderful step 1 Borrowing Relationship part. The employees during the branch will help you when you look at the operating their payment.

Affiliate Solution Contact Center. Get in touch with the newest Wonderful 1 Member Service Get in touch with Cardiovascular system by the getting in touch with 1-877-Golden step one (1-877-465-3361). Their customer care agents is guide you through the commission processes over the phone.

Payroll Deduction. Install payroll deduction that have Golden step 1 Credit Relationship. This package allows the loan costs becoming instantly deducted of the income, streamlining the new commission techniques.

On the web Statement Pay from A new Place. If you’d like to manage your finances through a separate lender, you could set-up on line bill spend and come up with loan repayments to help you Wonderful step 1 Credit Relationship. This process will bring independency and you can convenience.

You can relate to Golden step one Credit Union’s Loan Maintenance page for more detailed information and you can suggestions for and work out loan payments. So it funding offers a lot more expertise towards the commission process and you may options available for you.

Points to consider

- Qualification Criteria. Make sure you meet the creditworthiness and you can subscription requirements, because the Wonderful step 1 angles borrowing behavior towards the FICO Ratings and you may certain qualification standards.

- App Process. Familiarize yourself with the application form processes, which involves to get a cards partnership representative and taking needed personal and you may monetary pointers.

- Financing Terminology and you can Numbers. Understand the loan words provided, together with repayment symptoms and you will mortgage quantity between $step 1,000 upwards.

- Interest rates. Check out the aggressive undertaking APRs and ensure it align together with your budget and you may monetary possibilities.

- Cost Choices. Discuss the various strategies accessible to pay-off the loan, as well as online payments, branch visits, cell phone advice, payroll deduction, and online bill pay out of a different sort of institution.

- Later Payment Payment. Understand the late percentage percentage, and therefore wide variety to $15 for individuals who miss a cost deadline.

- Co-Candidates. If the need, imagine including a beneficial co-candidate for the application. Fantastic step 1 allows people to add a co-candidate for the app process.

- Beginner Finance. When you’re building credit, pay attention to the “beginner mortgage” option, which offers small repayment money. To have funds to $step 1,five hundred, zero co-signer is needed. For number to $2,five hundred, a good co-signer otherwise guarantor needs.

- Credit Objective. Believe whether or not the loan suits the created mission, whether it is combining expenses, making a significant purchase, or enhancing your borrowing from the bank character.

- Membership Criteria. Be sure you meet the membership conditions, especially if you reside outside California but qualify because of members of the family, home-based commitment, otherwise work.

https://cashadvanceamerica.net/personal-loans-nv/

Alternatives

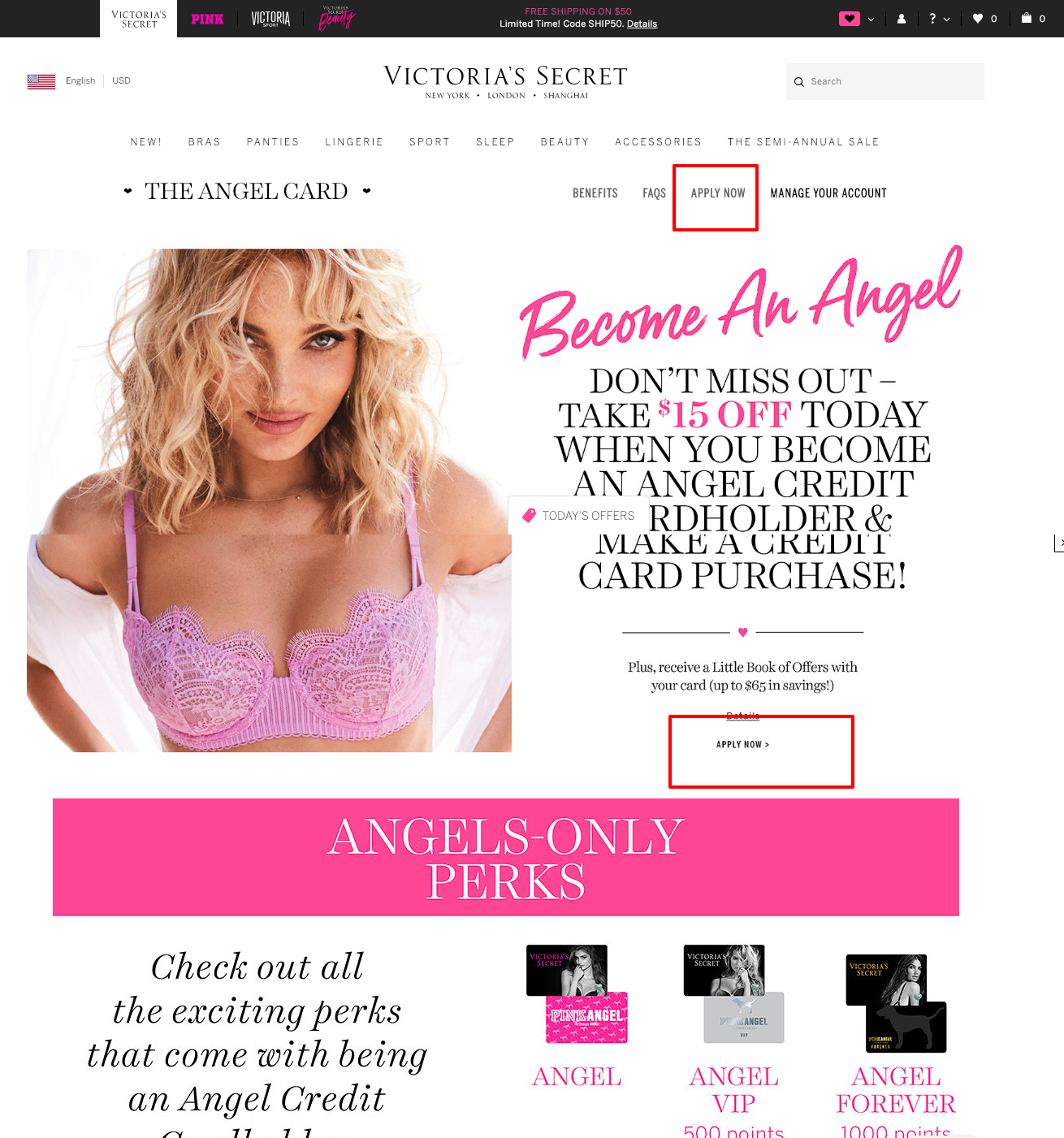

Playing cards. They will let you buy things and borrow money as much as their credit limit. You might will pay-off the bill completely per few days or bring a balance and make lowest costs. Samples of organizations giving handmade cards were Chase, Western Share, and determine.

Family Guarantee Loans/HELOCs. For many who individual a property, you can use its guarantee once the equity for a financial loan. Home equity funds bring a lump sum payment, if you find yourself domestic equity personal lines of credit (HELOCs) bring good rotating credit line. Wells Fargo and Lender away from The usa is loan providers offering family collateral products.

Peer-to-Fellow (P2P). P2P ending programs hook borrowers actually with personal loan providers or traders. Consumers receive funds funded by multiple traders. Do just fine and you may LendingClub was popular P2P lending platforms.

Store Resource. Certain retailers give funding for high purchases, like chairs or electronics. Such funds might have marketing symptoms having deferred interest. Ideal Buy and Apple try examples of enterprises giving merchant financial support.